Factors affecting the value of stocks

When first coming into the stock market, one of the first things that novice investors and traders need to do is learn how to identify the factors and patterns affecting the market and stock prices. Understanding what shapes demand for assets is the first step to successful trading. In this article, we detail the reasons why stock prices fluctuate in the stock market.

Short-term factors are often chaotic and have unpredictable outcomes, while long-term factors are logical and their impact on stock prices is easier to predict.

Contents:

- Supply and demand

- The global market’s conditions

- State regulation

- Long-term trends

- Financial results

- Analyst forecasts

- Insider deals and speculation

- News backdrop

- Be in tune with the market

Interact with the underlined words and green dots to get additional details and explanations.

💹 Supply and demand

Stock prices generally reflect the behavior and mood of market players. If, for one reason or another, more people want to buy a stock than those wanting to sell it, the stock’s price goes up. If a stock is actively traded but few people want to buy it, its price will fall. That is, stock market fluctuations reflect reactions to the behavior of traders and investors.

Next, we will consider the factors and causes that affect stock prices.

🦠 The global market’s conditions

The overall dynamics of the market and, accordingly, stock price fluctuations are influenced by economic and political events around the world as well as the state of countries’ foreign affairs. Such trends largely determine the behavior of investors and affect stock values from individual companies, whole sectors or even an entire country.

A clear example of this is the effect of the coronavirus pandemic. The lockdown put pressure on the entire stock market and put many industries at risk, particularly the tourism, air travel and real estate sectors.

For example, the March 2020 travel ban from Europe to the United States triggered a sharp drop in the shareprice of major airlines such as American Airlines (by 19%),

United Airlines (by almost 16%) and many others.

At the same time, the pandemic has been quite a profitable time for shareholders of pharmaceutical companies.

For example, since February 2020, Pfizer shares have risen by 41%,

Johnson & Johnson by 12.38% and

Moderna has increased in price by a whopping 636.8%.

Let’s highlight the main categories of impact on stock prices:

- Global economic and political events.

- Growth dynamics of a country’s economy or the world economy.

- Dynamics of a country’s federal discount rate, through which the state regulates the degree of economic growth.

🏛️ State regulation

State regulation has a strong impact on local stock prices. Governments can stimulate growth by creating favorable economic conditions, supporting tech and infrastructural development, launching tax incentives and promoting certain industries. On the other hand, if a state imposes restrictions, this leads to a fall in the exchange rate of its currency.

For example, in 2020, the US government provided social and economic support to the consumer goods sector. These measures led to an increase in retail goods sales, thanks to which Amazon increased its capitalization by 80.6%.

🌱 Long-term trends

Long-term trends in the global economy have a steady impact on stock prices. Currently, developing renewable energy sources and supporting environmental production and transport has skyrocketed in popularity across several developed nations. Naturally, the stocks of successful companies in these areas are likely to rise significantly in the long run.

It’s likely that everyone by now has heard of the largest electric vehicles manufacturer, Tesla. The company’s stock prices rise along with the growing demand for electric cars. On a regular basis, the company updates its models, puts new technologies into production and markets its products, all of which have been contributing to a steady increase in Tesla’s shares.

📊 Financial results

Stock prices can change following the publication of a company’s financial results and activity, as laid out in quarterly reports and annual reports. Generally, if the results meet or exceed the expectations of experts and investors, the company’s stock rises in price, and if they fall short of expectations, it falls. When selecting an investment opportunity, investors look for growth in a company’s net income and revenue as well as a decrease in debt. If a company can reach these goals, it becomes more attractive as an investment and its stock price rises. However, if a company cannot maintain its growth, investors may be tempted to sell off their shares.

For example, on July 29, 2021, Amazon’s quarterly report showed 27% profit growth year-on-year, down from 41% in 2020. The company also reported lower projections for the next year’s growth than investors were expecting. As a result, the company’s shares fell 7.5% after the report’s publication, despite being at an all-time high the day before.

Investor interest can be fueled by assurances from company management to increase dividend payments, improve financial performance or release a unique product. The more investor interest, the higher the stock price.

The reversal of negative dynamics to positive or vice versa is also a strong catalyst for the movement of a stock’s market price.

🎓 Analyst forecasts

Financial analysts monitor companies’ macroeconomics, news and financial results, conduct technical analyses and predict changes in stock prices. If analysts predict an upward price trend for a company’s stock, investors who share that opinion will start buying shares without waiting for the predicted price change itself. As a result, the demand for shares increases, leading to their price rise. With their influential opinion, experts and opinion leaders in social networks can create a trend to buy certain shares. This, of course, works in the opposite direction as well, wherein analysts can predict a negative change in price, causing investors to drop their holdings in the company, thus decreasing demand.

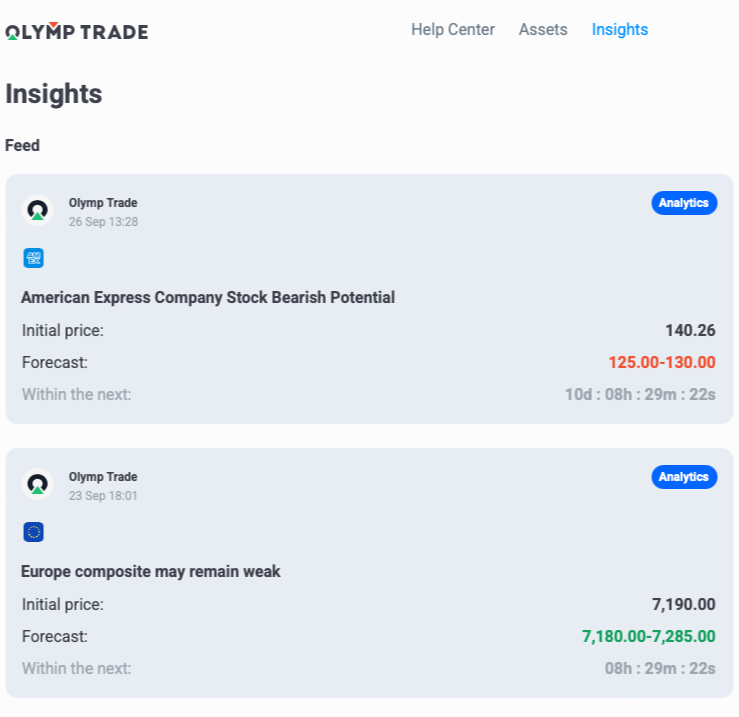

Fig. 1. Gapflix Trade's Insights

Gapflix Trade’s Insights section includes such analytics as well as economic calendar events and their potential effect on stocks. We recommend using it as a guide along with technical tools in your trading strategy.

🤝 Insider deals and speculation

Insiders include top managers and company executives, whose trading activity ordinary investors like to watch. Some take the opportunity to copy trades of insiders who are actively buying or selling shares. The larger the deal, the more interest it generates, and the more investors join in on it. This eventually causes the stock price to move.

On the other hand, stock market fluctuations can sometimes be caused by speculation or rumors — for example, about higher dividends. Thus, a stir is created and shares are bought up on a mass scale. This is done not to receive a percentage of the profit at the end of the year but to resell at a higher price. Demand rises — prices rise. However, this can be done with malicious intentions.

📰 News backdrop

Investigations by journalists, the publication of insights, or statements from popular people all have an impact on stock price fluctuations. The news may report that the company is pursuing unfair policies, distorting facts or planning a major deal. Both good and bad news can affect prices.

In 2015, for example, Volkswagen was publicly accused of underreporting environmental emissions during its vehicle tests, which sent its stock price down nearly 16%. In half a year, the company’s value fell from €120 billion to €45 billion.

🔉 Be in tune with the market

Stock market fluctuations are always changing and cannot be predicted with 100% certainty. Now that you are armed with up-to-date information about the factors affecting stock price fluctuations, you’ll be able to more easily navigate the stock market.

That being said, we do recommend you check out our other articles on the matter: Riding the wave of volatility and How to identify breakout stocks.

Join the Gapflix Trade platform, put acquired knowledge into practice and trade stocks in three trading modes. Enrich your trading experience and become a force to be reckoned with in the markets!

Go to Gapflix TradeRisk warning: The contents of this article do not constitute investment advice, and you bear sole responsibility for your trading activity and/or trading results.

Start Trading Stocks