Uncertainty in the Financial Markets Remain the Main Driver

Sanctions, new COVID restrictions, and risk off sentiment is what is driving the financial markets currently.

Interact with the underlined words and green dots to get additional details and explanations.

EXXON ↑7.09%

$141.8 gained on a x20 Up trade

GBP/JPY ↑3.81%

$1,425 gained on a x500 Up trade

NZD/USD ↓2.07%

$1,035 gained on a x500 Down trade

Overview

Forex

The dollar may continue to strengthen if US May inflation data surprises to the upside and prompts calls for more aggressive Fed tightening. The euro has come under pressure from statements that the situation in Europe is not going better and Russian sanctions backfired.

On the other hand, the prospect of increasing the interest rate of the European Central Bank due to rising inflation keeps the euro in the focus of currency traders.The risk-off mood, political turmoil, and Brexit jitters weigh on the pound sterling. Additionally, the Japanese government is unlikely to intervene to support the Japanese yen at this time, but if disorderly moves persist, this scenario should not be ruled out.

Stocks

The benchmark S&P index has fallen for a fourth straight day, with the index now down more than 20 percent from its latest record closing high to confirm a bear market started on Jan. 3, to a new low for the year. The Dow Jones fell more than 875 points, or 2.8%, and the technology composite Nasdaq slumped 4.7% continuing to deteriorate in once-high-flying technology stocks.

Commodities

The price of commodities such as Brent oil and natural gas remain high due to supply chain disruptions and new COVID restrictions in China.

Crypto

Bitcoin plunged to slightly above $20,000 after range trading for the past few weeks. Traders and investors are assessing risks and uncertainty as far as cryptocurrencies.

Forex

GBP/USD Price Forecast is Still Neutral Downwards

Primary next-day price movement expectation: Down to 1.2400

Secondary next-day price movement expectation: Up to 1.2676

Fig.1. GBP/USD on a Daily time frame

GBP/USD remains in a consolidation phase within the 1.2450-1.2670 area, and below the 50-day SMA at 1.2676 for the 8th straight trading day as risk aversion boosts demand for the greenback. Despite the ongoing correction, which lifted the currency from this year's lows at 1.2155 towards the 1.2670s, GBP remains biased downwards neutral. In the near term, GBP/USD's first resistance will be the 50-day SMA at 1.2676. GBP/USD's first support level is 1.2500, followed by the June 7 swing low at 1.2430 and by the 1.2400 figure.

The last point of a fresh bearish move could be the 1.1500 area, which is near the March 2020 low. However, before aiming the pair to these historical levels, the bears have yet to prove their strength.

EUR/USD Bullish, Look for Valid Signals

Primary next-day price movement expectation: Up to 1.07968

Secondary next-day price movement expectation: Down to 1.06711

Fig. 2. EUR/USD on a Daily time frame

The price of EUR/USD continues to rebound and the daily bias of EUR/USD seems to be in a bullish condition. If the EUR/USD moves downwards and is stuck around the critical area at the range 1.07339-1.07008, then wait for the appearance of a valid bullish candlestick pattern and pay attention to the RSI indicator moving upwards then there is potential for the price to touch the 1.07968 area. Only a close above 1.0764 would risk a stronger advance towards 1.0786, but 1.0807 should hold initially.

On the other hand, be alert if the EUR/USD price continues to decline and penetrates the 1.07008 level that there is potential for the price to reverse direction with a bearish move down towards the next level at the range 1.06711.

Stocks

Alibaba Jumps to Highest Level Since February

Primary next-day price movement expectation: Up to 125

Secondary next-day price movement expectation: Down to 108.25

Fig. 3. Alibaba on a Daily time frame

The Alibaba Group led another rally in Chinese technology stocks on Wednesday, providing renewed hope for rising stocks that the nascent rebound in technology stocks can be sustained. Alibaba shares climbed almost 15% as the Chinese Internet giant benefitted from signs that the Beijing government is taking new steps to support its tech sector after a year of crackdowns and regulatory influence. With Wednesday's gains, Alibaba shares ended the day at $119.63, their best close since February.

Alibaba shares are already in the overbought zone when viewed from the RSI indicator. It is possible that in the future the price will be in a correction phase, or the stock price will move downwards. Although the price decline is not too sharp, the price is likely to be around the $115-$120 level. If it breaks the $120 level, the price will probably head upwards towards the $125 level which is also the 200-day SMA. Another scenario for this stock is if the price declines, in which case the price will be stuck at the support level at $108.25.

Commodities

Brent

Primary next-day price movement expectation: Up to 127

Secondary next-day price movement expectation: Down to 120

Fig. 5. Brent oil on a Daily time frame

The price of Brent remains high and is trading above $120 per barrel. Disruptions in supply chains due to the EU oil embargo is going to remain one of the hot topics and weigh on the price of Brent. Additionally, new COVID restrictions in China dampen the outlook for demand.

We expect the price of Brent oil to remain elevated. Goldman Sachs raised their outlook for Brent to $135 as far as the second half of 2022.

Natural Gas

Primary next-day price movement expectation: Up to 9.428

Secondary next-day price movement expectation: Down to 8.126

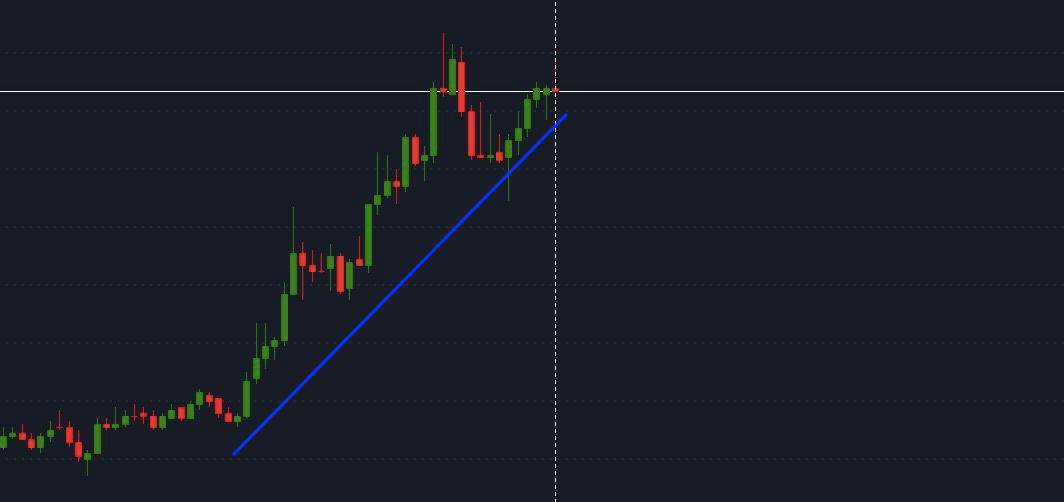

Fig. 6. Natural Gas on a Daily time frame

The price of natural gas remains volatile. An explosion in one of the largest US export plants producing liquefied natural gas (LNG) raises the risk of disruptions in the supply chains for Europe. We expect that the price of natural gas will remain high. The price is following uptrend line support from March 2022.

Crypto

Bitcoin

Primary next-day price movement expectation: Up to 31,500

Secondary next-day price movement expectation: Down to 29,000

Fig. 7. Bitcoin on a Daily time frame

Bitcoin continues to trade in a range slightly above $30,000. The uncertainty in the financial markets seems to outweigh the outlook prospects for riskier assets.

Risk warning: The content of the article does not constitute investment advice and you are solely responsible for your trading activity and/or trading results.

Expert Review